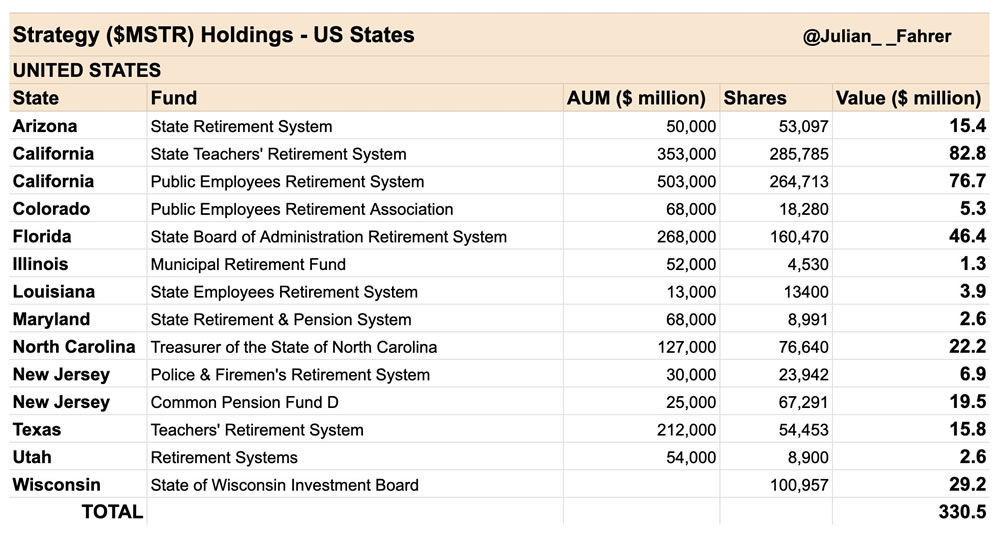

Twelve US states have reported holding Strategy, formerly MicroStrategy, stock in their state pension funds and/or treasury in 2024.

That’s $330 million in total.

According to the filings, the list of States includes Arizona, California (two separate funds), Colorado, Florida, Illinois, Louisiana, Maryland, North Carolina, New Jersey (two separate funds), Texas, Utah and Wisconsin.

Guess who the largest stakeholder is?

If the answer was California, you’re right.

California holds a grand total of around 550,000 shares, worth around $160 million.

California is also one of two states (along with New Jersey) to hold MSTR in more than one fund, namely the State Teachers’ Retirement System and the Public Employees Retirement System.

The second largest stakeholder is Florida, with 160,470 shares.

Every other state is far, far back.

The third-largest, North Carolina, ‘only’ holds 76,640 shares.

The smallest stakeholder is Illinois, with 4,530 shares.

Leave a comment