I don’t use credit cards anymore, only debit, and I’m exploring different options.

I am not really anti-subscription plans in principle, although I feel like, for the most part, they’re not worth my pennies.

At the moment, I’m trying out two different ones that have exactly the same cost, but provide totally different perks.

One is with Curve. The other one is with Wirex.

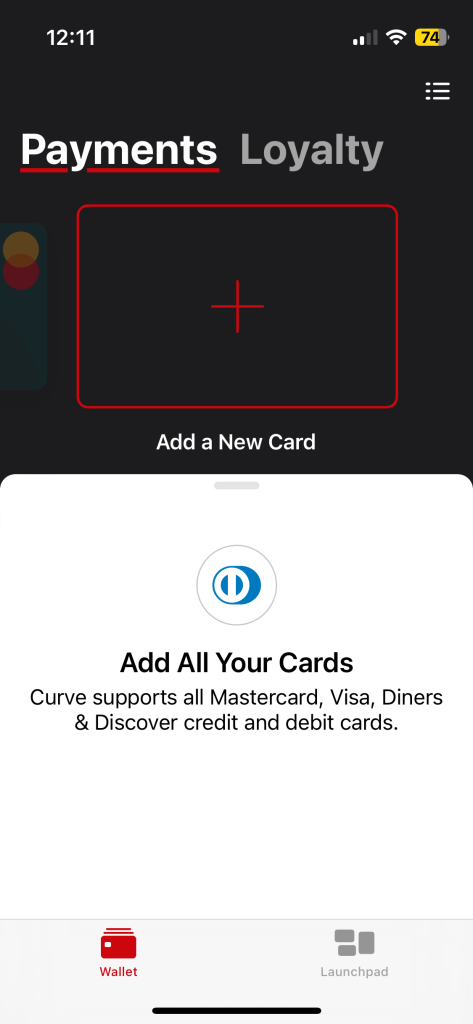

Curve is a card provider that combines all your cards in one. This is not a figure of speech or a marketing ploy, it is the literal definition of what the app is for.

It comes with a unique feature, it allows you to link as many cards as you like to your Curve card.

Then, once your cards are linked, you can choose which one to use from the app.

There are two ways this is useful.

First, it allows you to carry one card for everything, rather than three or four or five.

And second, it allows you to then any virtual card into a physical one.

The Curve Black subscription adds two advantages to that.

First, the number of cards you can link goes 2 from to 5 and second, it allows you to use ‘go back in time’ feature.

Up to 90 days after a transaction takes place, you can ‘move’ it from card A to B or vice versa.

The Curve Black subscription used to include travel insurance, but this was unfortunately discontinued in December 2023.

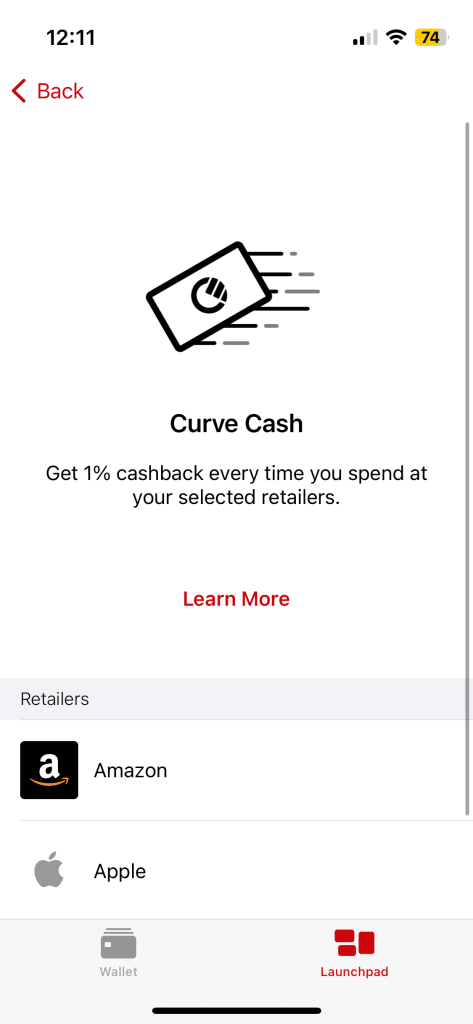

Cashback-wise, you can select up to 3 retailers you get cashback from.

I chose Apple, Amazon and the largest supermarket chain in my homeland.

This, in my view, is a perk but also a bit of a disappointment. It’s nice to get 1% cashback from these retailers, but the list should be longer.

The cashback can be spent directly with the card.

Wirex is a crypto exchange and as such, the whole point of the card is it allows you to spend your crypto funds.

The standard Wirex card is pretty good. You get it for free and, apart from withdrawals, there are no fees, regardless of which currency you use.

And you get a 0.5% cashback (in WXT token), no questions asked.

You can top it up with your other cards (with a fee) or via SEPA wire transfer (free).

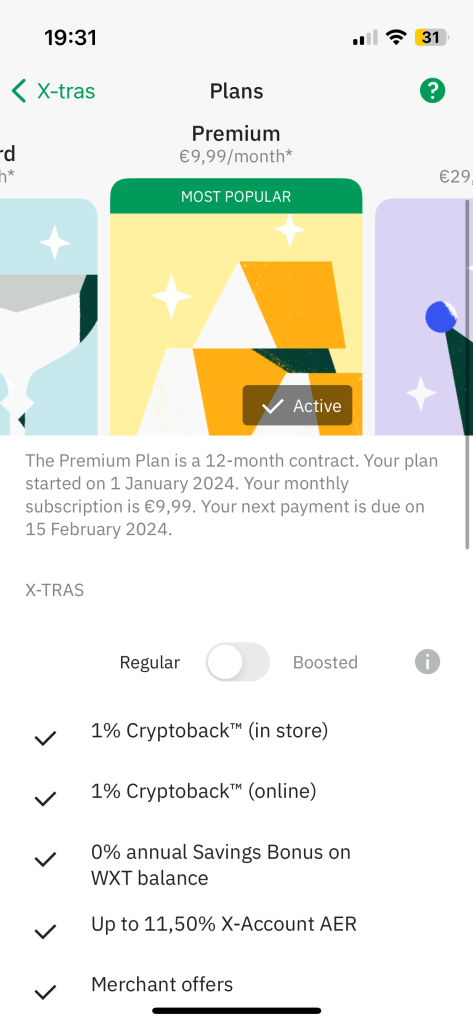

With the Premium monthly subscription, the only real world advantage is the cashback goes up to 1%, which is pretty good. And you also get extra percentage points on both the flexible and locked savings plans. Up to 16% on stablecoins and up to 8-9% on crypto.

The only drawback is the cashback is paid in WXT and you can’t convert that to other currencies until you get to a minimum of between $100 and $200.

This is pretty high, to be honest.

But it works fine by me because I also use Wirex for interest on crypto. So I exchange WXT once a month, usually.

To sum it all up:

Curve Black – €9.99 per month

Pros

- Convenience of having card in your pocket instead of four or five

- Turns any virtual card into physical

- 1% Cashback on major retailers

- Flexibility with the ‘go back in time’ feature

Cons

- Not enough retailers

- No travel insurance

- No lounge access

Wirex Premium – €9.99 per month

Pros

- 1% cashback on everything, online and offline

- Extra interest on crypto and/or stablecoins

- Fee is payable in Wirex’s native token, no need to use your crypto or fiat

Cons

- There’s always a risk associated with centralised exchanges

- Cashback is paid in Wirex token WXT, and the minimum threshold for converting into other cryptos or FIATs is fairly high

Leave a comment